I’m sure you have heard of the idiom that we should all prepare for a rainy day, right? Do you actually know what it means to prepare for a rainy day? For most of you, the underlying meaning is obvious, but to be completely honest, it wasn’t always that clear to me. Until I was about 20 years old, I thought this literally meant that you should have some cash stashed away so you can still do something fun when it’s raining outside. Am I just stupid? Maybe. But it just goes to show you that even a supposed financial guru doesn’t always understand the simplest of things. So, let’s dig into the real meaning of what it means to prepare for a rainy day and why we should do it!

Prepare For a Rainy Day

As many of you probably already knew, when one prepares for a rainy day, they are socking away money not for when it literally rains, but for when something devastating might happen to their finances. This fund could be set up in case you lose your job, get an illness, or in case you get hurt in an accident. If any of these things happen, then you can simply open up your rainy day fund and continue to survive, even with your misfortune.

The Reality Today

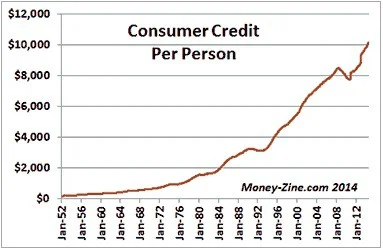

Did you know that the average credit card debt per person exceeds $10,000 today? Not only are we not saving for a rainy day, but we’re digging ourselves further and further into debt!

If the chart above isn’t bad enough, a recent article in USA Today informs us that 1/3 of Americans today have less than $1,000 tucked away that could be used for a future event like retirement! So, not only are we building up debt, but we’re saving absolutely nothing at the same time. When that rainy day comes along, what do you think is going to happen to these people? Nothing good, I can tell you that much.

Let’s put ourselves in the scenario above (which is apparently pretty common when reading through the percentages). Let’s say that you and your spouse are both working and earn $3,000 a month after taxes. You have $9,000 in credit card debt and you’ve got $500 in the bank. Most of the time, you put no additional money into savings, but if you really scrimped and saved, you and your spouse could probably hold onto about $200 after all the bills were paid and stomachs were fed.

Unfortunately, that fateful day has come; the rainy day. You didn’t see it coming at all, but your company has decided to downsize and your job has been eliminated. Without warning, your income is gone. What do you do?

- Live off your savings? Oh wait, you only have $500 in there

- Live off unemployment? Crap, that first check won’t come for about a month and is only 60% of your regular paycheck, so that won’t pay all the bills anyway.

- Find another job quickly? Nothing with comparable pay is available. You can find a job quickly, but the pay is lousy, so you may as well just hold out and take unemployment.

- Live off credit cards? That seems pretty scary, but it looks like it’s the only option.

Well crap, you lost your job expectantly and now your only lifeline for your family is your credit card. You don’t need me to tell you that this could go south very quickly and land you in bankruptcy court. It’s a scary thing to think about, but it’s real. What can you do to avoid it? Say it with me: PREPARE FOR A RAINY DAY.

How to Prepare For a Rainy Day

This may seem pretty basic, but saving money isn’t all that easy. It requires discipline and consistency with your money. To start saving effectively, you really need to write out a budget plan for yourself. That is step 1.

1) Write out a budget – It isn’t fun, but it is super effective. After you write out a budget, you’re going to realize that you had no idea what you spent your money on each month! It happened to me, and it will likely happen to you too. But, as you get better at understanding your spending, you can move on to step 2 and cut down on some of those senseless costs!

2) Cut your costs – When you know what you’re spending your money on, it becomes natural to question “Why?”. When I started to question my expenses, I made some phone calls and got my bills reduced! I called the cell phone company, the insurance company, and the bank. Each one of these phone calls saved me hundreds of dollars per year and allowed me to save more money each month.

3) Force your savings – As you get more comfortable with your budget and cut out some costs, you’ll probably be able to save $400-$500 a month instead of the measly $200 you were able to scrounge up before. To stay consistent with these savings, it is best to force them directly into your savings account with your direct deposit. With each direct deposit, you can actually direct a certain percentage (or dollar amount) of your funds to various accounts. Use this tool to put your money directly into your savings to prepare for a rainy day!

Are you ready to prepare for a rainy day?

This post was originally published on February 19, 2015, and updated on May 29, 2022.